Cambodia: Penalties for Violation of the Law on the Management of Commercial Gambling and Instructions on Managing Casino Operations and Game-of-Chance Businesses in Cambodia

by Keovattey Ngoun

On 31 May 2022, Sub-Decree 102 on Transitional Fines for Violation of the Law on the Management of Commercial Gambling (“Sub-Decree 102”) was issued by the Royal Government of Cambodia (“RGC”) pursuant to Article 92 of the Commercial Gambling Law. Subsequently, on 20 October 2022, the Commission of Commercial Gambling of Cambodia (“CCG”) issued Instruction 18 on Managing Casino Operations in the Kingdom of Cambodia (“Instruction 18”) and Instruction 17 on game-of-chance businesses (“Instruction 17”).

Transitional Fines for Violation of the Commercial Gambling Operation

Sub-Decree 102 imposes transitional fines for owners of integrated commercial gambling centers, casino owners, commercial gambling operators and other relevant persons who violate the licensing regime implemented by the CCG. This includes, but is not limited to, the use of an expired license, the transfer of a license to another person without CCG approval and the failure to commence operations during the period set out in the gambling business license. Specifically, using an expired casino license may give rise to a fine of 8 million riel (approx. USD 2,000) per day or a fine of 4 million riel (approx. US$ 1,000) per day for failing to commence the business within the period specified in the casino license. Any purported transfer of a casino license without prior approval of the CCG may give rise to a fine of 100 million riel (approx. USD 25,000).

Importantly, Sub-Decree 102 imposes fines directly on special personnel (defined under the Commercial Gambling Law as personnel working in a casino and having authority to manage and make decisions relating to the management of casino operations or other personnel with specific duties), who perform duties in a casino operation without the required license, in an amount of 10 million riel (approx. USD 2,500). In addition, operating as a commercial gambling promoter or the producer/manufacturer, installer, importer, seller and/or distributor of gaming equipment and/or program without the required license may give rise to a fine of 100 million riel (approx. USD 25,000).

Transitional Fines for Violation of the Obligation Income

Pursuant to Article 81 of the Commercial Gambling Law, casino operators, betting operators, game-of-chance operators and other commercial gambling operators are required to pay the fees and expenses as mandated by law. The commercial gambling operators may be fined 2 million riel (approx. USD 500) per day if they fail to submit a periodical declaration of the income earned from gambling operations to the CCG. If the obligation income is not accurately paid to the CCG, such persons will also be subject to a fine pursuant to Sub-Decree 102.

Transitional Fines for Violation of the Regulated Obligations

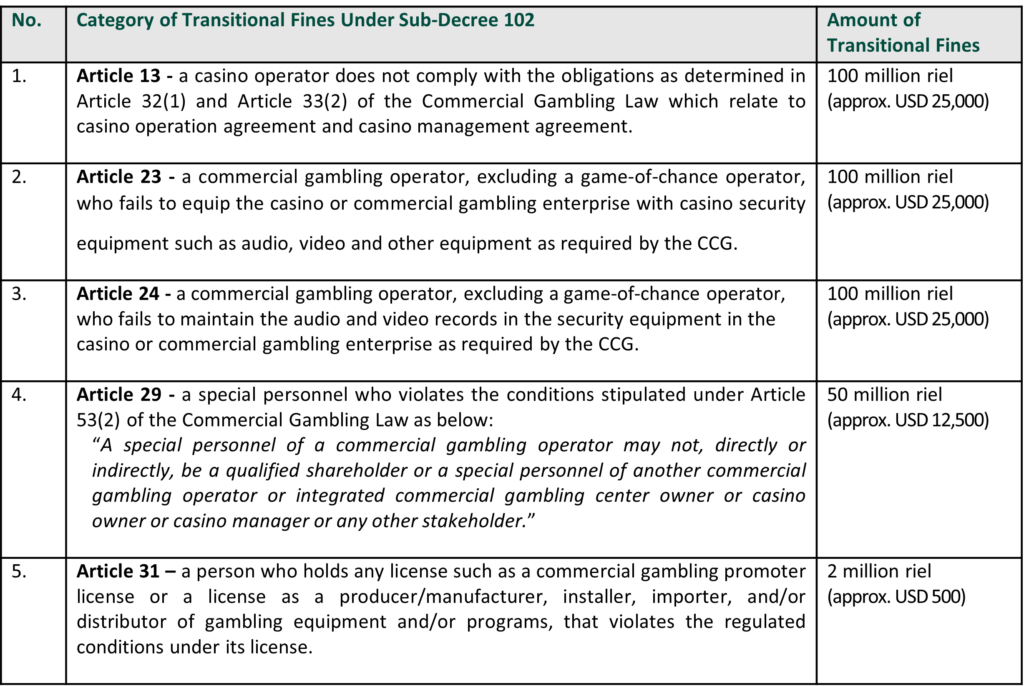

Sub-Decree 102 sets out the transitional fines applicable for violation of certain obligations under the Commercial Gambling Law:

Filling Complaint Against the CCG Regarding the Transitional Fines

While Sub-Decree 102 authorizes the CCG to impose penalties for persons involved in commercial gambling operations, if the legal entity accused of violating Sub-Decree 102 wishes to challenge the imposition of the transitional fines, such a legal entity may file a complaint letter with the director of the CCG within 15 days after the receipt of the fine.

If satisfied with the decision of the director of the CCG, the entity concerned can file a complaint with a competent court within 30 days after receiving notice of the CCG director ‘s decision.

Under Article 92 of the Commercial Gambling Law, payment of the transitional fines leads to the cessation of any criminal action. If the offender refuses to pay the transitional fines, the matter must be referred to a competent court for further action.

New Obligations Regarding the Validity of Casino License and Game-of-Chance License

A casino operator, and/or a casino owner and/or a game-of-chance operator (“Operator”) must obtain a valid casino license or a game-of-chance license from the CCG to operate commercial gambling in Cambodian territory. The Operator must operate its commercial gambling activities pursuant to the conditions and at the location stipulated in its license.

Furthermore, an Operator must publicly display the original licenses, not a copy, in its business locations where it can be easily seen.

The recent adoption of Sub-Decree 102 is an indication that the CCG is actively enforcing the Commercial Gambling Law. We recommend that you confirm the validity of your license and operating period and assess your operation materials to check whether they are in full compliance with the Commercial Gambling Law. Also, if you are a special personnel and are not sure about your duties and obligations under the Commercial Gambling Law, please feel free to contact DFDL.

Should you have any concerns or queries on the matters mentioned above, please feel free to contact our team at [email protected].

The information provided here is for information purposes only and is not intended to constitute legal advice. Legal advice should be obtained from qualified legal counsel for all specific situations.

Read more Legal & Tax Updates

Read more about DFDL

Read more about DFDL Cambodia

The post Cambodia: Penalties for Violation of the Law on the Management of Commercial Gambling and Instructions on Managing Casino Operations and Game-of-Chance Businesses in Cambodia appeared first on DFDL.