New Extension of Deadlines for Compliance with the Tax Obligations is Established as a Result of the Extension of the Declaration of National Emergency

New extension of deadlines for compliance with the tax obligations is established as a result of the extension of the declaration of national emergency

Due to the extension of the State of National Emergency until April 12, 2020, through Superintendence Resolution No. 065-2020/SUNAT published on March 30, 2020, new expiration dates are established for certain tax obligations:

A. For taxpayers receiving third category income, who in taxable year 2019 have earned a net income of up to 2,300 Tax Units (S/ 9’660,000.00) or who have obtained or received revenues other than third category income, which added up do not exceed such amount:

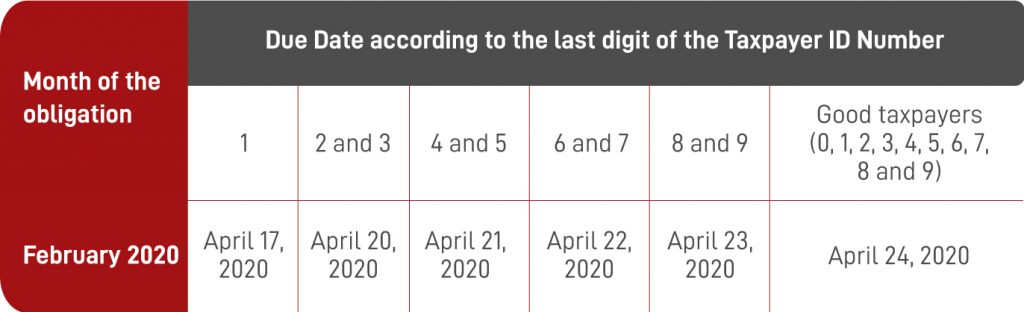

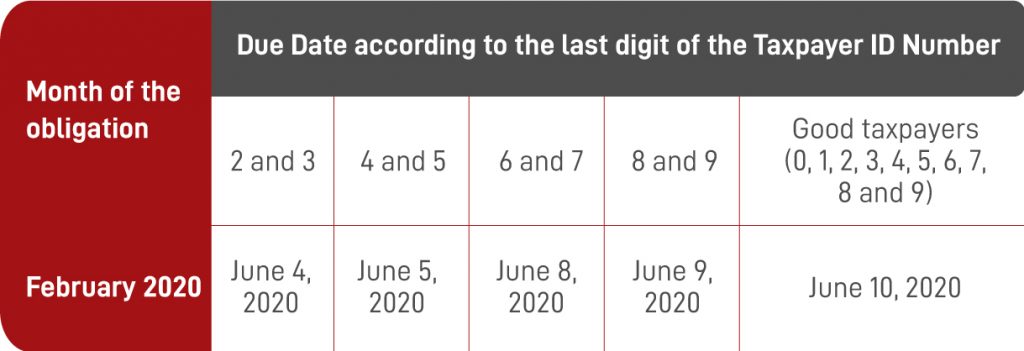

i) The due dates for the declaration and payment of monthly tax liabilities for the month of February 2020 (except those declared through PLAME) are extended as follows:

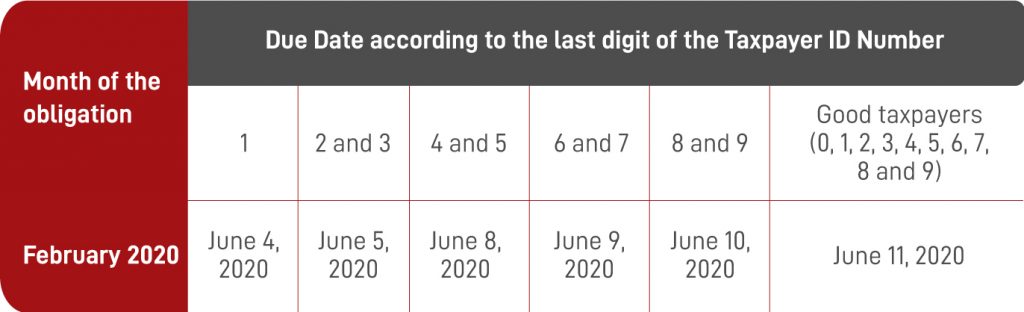

The deadlines for the declaration and payment of the concepts contained in the PDT Electronic Sheet - PLAME, Virtual Form Nº 0601, corresponding to the period February 2020 are extended as follows:

ii) The deadlines with respect to the Register of Sales and Revenues and the Register of Electronic Purchases of Annex II of Superintendency Resolution No. 269-2019/SUNAT for February 2020 are extended as follows:

iii) The deadlines with respect to the tax related books and records that are kept physically (Resolution No. 234-2006/SUNAT) and electronically (Resolution No. 286-2009/SUNAT) -which originally expired between March 16, 2020 and May, 2020- was extended until June 4, 2020.

iv) The delivery deadlines for submission to SUNAT, directly or via OSE where applicable, of information statements and communications from the Electronic Issuing System, -which originally expired from March 16, 2020 until April 30, 2020- were extended until May 15, 2020.

v) The deadline for submitting the Annual Declaration of Transactions with Third Parties (DAOT),-which originally expired from March 16, 2020 to March 31, 2020- was extended until May 29, 2020.

vi) It is ordered that these new expiration dates will be applied in order to establish the deadlines that taxpayers have to submit a request for the refund of credit balance in favor of the benefit from March or later months.

B. For taxpayers receiving third category income, who in the taxable year 2019 have earned a net income of up to 5,000 Tax Units (S/ 21,000,000.00) or who have obtained or received revenues other than third category income, which added up do not exceed such amount:

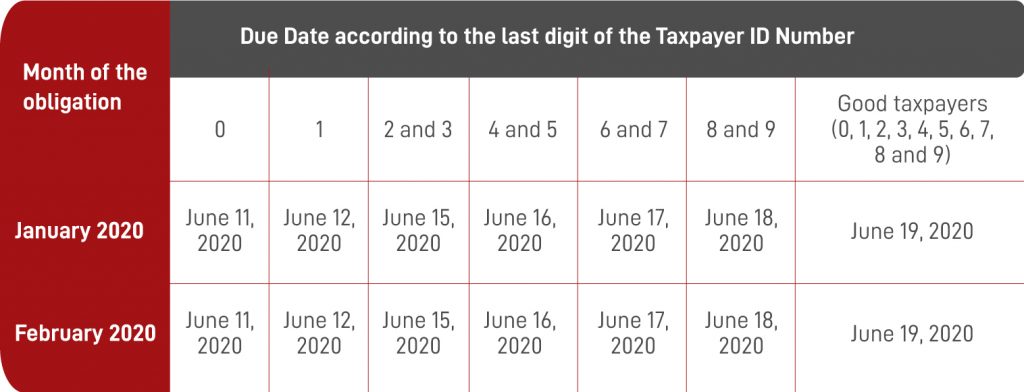

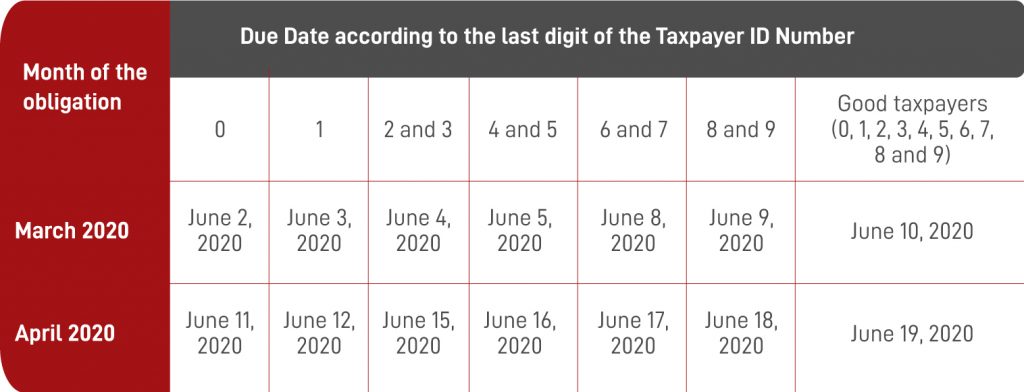

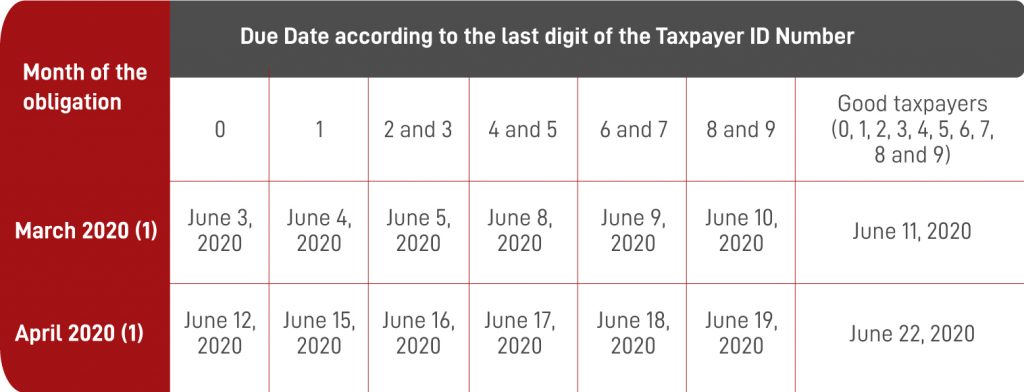

i) The deadlines for the declaration and payment of the monthly tax obligations for the months of March and April 2020 (except those declared through PLAME), are extended as follows:

(1) The deadlines for the tax return and cash payment of the installments of the Net Assets Tax (ITAN) are included.

ii) The deadlines with respect to the Register of Sales and Revenues and the Register of Electronic Purchases of Annex II of Superintendency Resolution No. 269-2019/SUNAT (applicable to taxpayers obliged to keep books electronically from 2020) for the months of January and February 2020 are extended, as follows:

iii) The delay deadlines with respect to the Register of Sales and Revenues and the Register of Electronic Purchases of Annex II of Superintendency Resolution No. 269-2019/SUNAT (applicable to taxpayers who have already voluntarily or were obliged to keep electronic books before 2020) for the months of March and April 2020, are extended as follows:

C. For taxpayers receiving third category income, who in the taxable year 2019 have earned a net income greater than 2,300 Tax Units (S/ 9,660,000.00) and up to 5,000 Tax Units (S/ 21,000,000.00) or who have obtained or received revenues other than third category income, which added up do not exceed such amount:

i) The delay deadlines with respect to the tax related books and records that are kept physically (Resolution No. 234-2006/SUNAT) and electronically (Resolution No. 286-2009/SUNAT) -which originally expired between March 31, 2020 and May 2020- are extended until June 4, 2020.

ii) The delivery deadlines for submission to SUNAT, directly or via OSE where applicable- of information statements and communications from the Electronic Issuing System, -which originally expired from March 31, 2020 to April 30, 2020- are extended until May 15, 2020.

iii)The deadline for submitting the Annual Declaration of Transactions with Third Parties (DAOT), - which originally expired from March 31, 2020 to April 30, 2020- was extended until May 29, 2020.

iv) It is ordered that these new expiration dates will be applied in order to establish the deadlines that taxpayers have to submit a request for the refund of credit balance in favor of the benefit from March or later months.

The extensions referred to in paragraphs B and C above also apply to those persons who are not subject to income tax, other than the National Public Sector.

Tax deferral and/or differ payment.- The same Superintendency Resolution orders that for all tax debtors who were granted a tax deferral and/or differ payment benefit that is in force until March 15, 2020 (including major taxpayers), the installments that become due on March 31, 2020 and April 30, 2020 that are not paid on a timely manner shall not be considered for the loss of the tax deferral and/or differ payment benefit if they are paid until May 29, 2020, together with the corresponding default interests.

Link to article

Post a comment

Post a comment Print article

Print article