Regulations of Interest

Powers to legislate on tax matters are delegated to the executive branch regarding COVID-19.- Law No. 31011 approved the delegation of powers to the executive branch for a period of 45 calendar days to legislate on the following tax matters:

i) Temporary suspension of existing fiscal rules and establishment of measures for the national economic recovery.

ii) Payment facilities for tax liabilities administered by SUNAT.

iii) Amend the Income Tax legislation with regard to the procedure of payments on account, loss carry-forward, depreciation periods and expenditure on donations.

iv) Extend the scope of application of the tax refund scheme of Law No. 30296.

v) Extend the period of authorization for SUNAT to exercise functions under the Digital Signatures and Certificates Act.

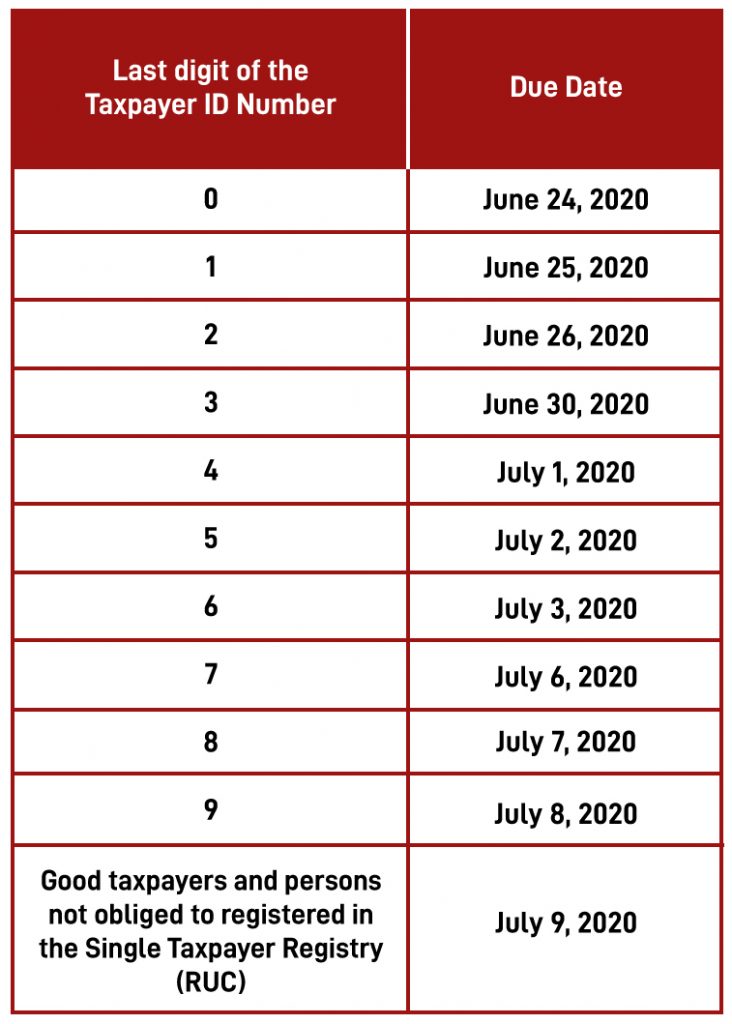

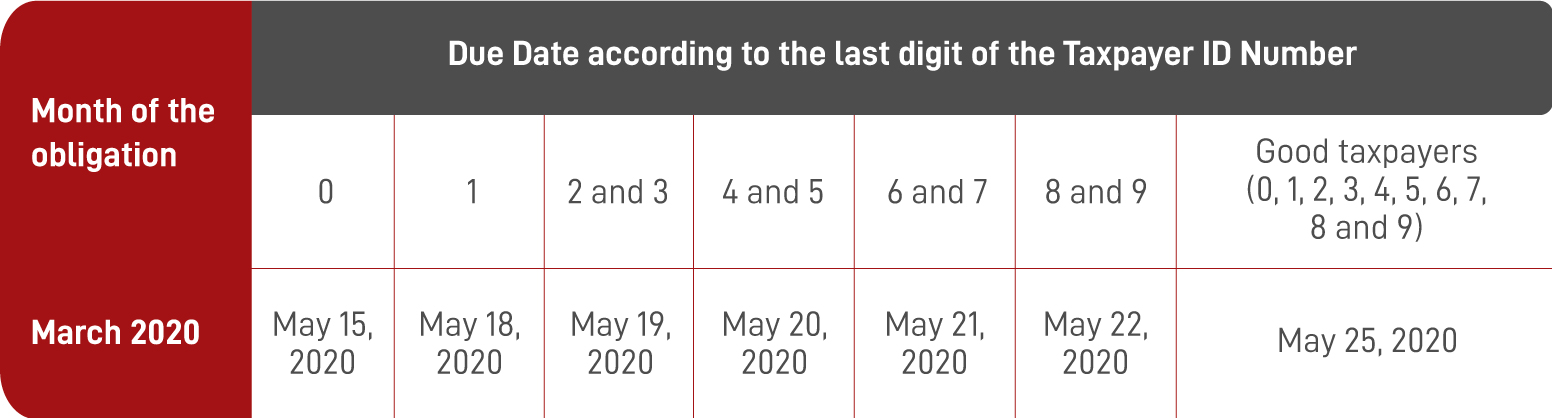

The scope of the extension of the deadline for the submission of the 2019 income tax return and payment is expanded. - Superintendency Resolution No. 61-2020/SUNAT, published on March 24, 2020, orders that tax debtors receiving third category income and who have obtained a net income of up to 5,000 Tax Units (S/ 21,000,000.00) in taxable year 2019 or who have obtained or received revenues other than third category income, which added up do not exceed the amount above, must submit the Annual Financial Transaction Tax and Income Tax Return according to thefollowing maturity schedule:

The original maturity schedules for the annual income tax return and payment of all other taxpayers not included in this provision are maintained to date (second paragraph of the Seventh Supplementary Final Provision of Superintendency Resolution No. 271-2019/SUNAT).

A discretionary power not to sanction the infringements under the Tax Code is approved.- Resolution of the Associated National Superintendency of Internal Taxes, No. 008-2020-SUNAT/700000, published on March 18, 2020, orders not to impose administrative sanctions on tax infringements incurred by tax debtors in general during the State of National Emergency declared due to COVID-19 including those infringements committed or detected between March 16, 2020 and the date of issue of this resolution.

It is specified that the payments of penalties made until March 17, 2020 will not be returned or paid-off.

The order does not include the exemption of default interest related to any non-payment of taxes.

Special procedures for the registration in the RUC (Single Taxpayer Registry) and obtaining the Clave SOL key.- Through Superintendency Resolution No. 062-2020/SUNAT, published on March 25, 2020, a fully virtual procedure is established for the registration in the RUC and obtaining the Clave Sol key for the natural persons contracted by the public administration entities to face the outbreak of COVID - 19.

Automatic Income Tax Refund paid in excess by natural persons: Emergency Decree No. 031-2020, published on March 23, 2020, empowers SUNAT to make ex officio refunds of taxes paid or withheld in excess of fourth and/or fifth category income tax for year 2019, before the due date for submitting the Annual Income Tax Return for that year (which was the original deadline for making the refund).

Automatic Refund of Taxes paid or withheld in excess under Law No. 30734.- Supreme Decree No. 056-2020-EF amends the Regulation of Law No. 30734 in order to adapt it to the amendments provided for by Supreme Decree No. 025-2019 which, inter alia, established that the ex officio refund will be carried out using account deposits or any other mechanism approved by supreme decree. In this sense, it is foreseen that when the taxpayer’s account number or CCI is not valid, the ex officio refund will be carried out through a Financial System Payment Order the if the taxpayer has a Peruvian ID, or a non-negotiable Cheque if the taxpayer has a different identity card.

Extension of the deadline for the issuance of authorized documents in physical format.- Superintendency Resolution No. 060-2020/SUNAT orders that the companies that play the role of acquirer in the credit card and/or debit card payment systems and the operators and other parties, other than the operator, of irregular companies, consortia, joint ventures or other business partnership agreements, can issue the authorized documents referred to in sections j), m), n) and q) of paragraph 6.1 of point 6 of Article 4 of the Regulation on Payment Receipts without using the Electronic Issuance System.

A new extension of the deadlines for the fulfilment of tax obligations is established due to the extension of the declaration of national emergency.- Due to the extension of the State of National Emergency until April 12, 2020, through Superintendency Resolution No. 065-2020/SUNAT, published on March 30, 2020, new expiry dates for certain tax obligations are established:

A. For taxpayers receiving the third category income, who have earned a net income of up to 2,300 Tax Units (S/ 9,660,000.00) in the taxable year 2019, or who have obtained or received revenues other than third category income, which added up do not exceed that amount above:

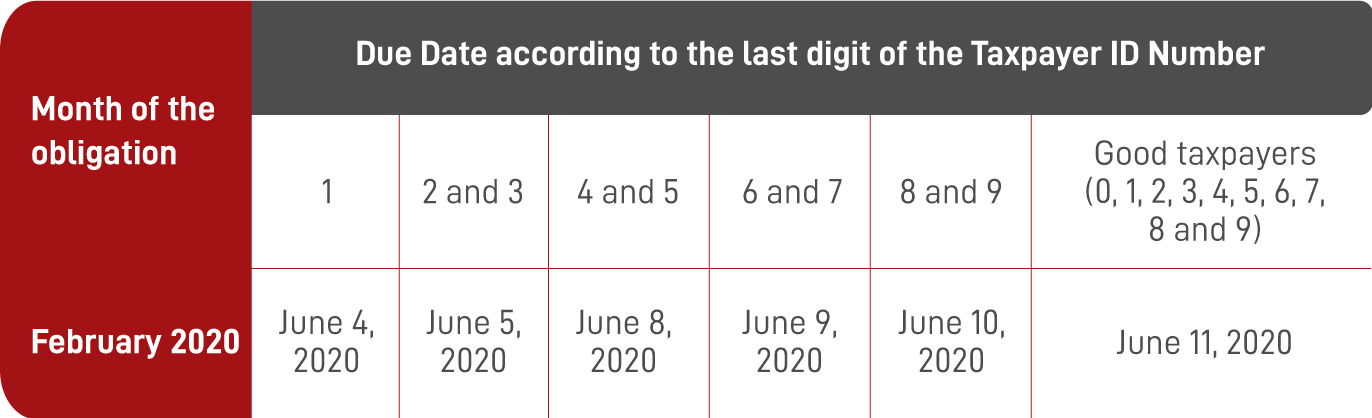

i) The due dates for the declaration and payment of the monthly tax liabilities for the month of February 2020 (except those declared via PLAME) are extended as follows:

The deadlines for the declaration and payment of the amounts contained in the PDT Electronic Form - PLAME, Virtual Form Nº 0601, corresponding to the February 2020 period are extended as follows:

ii) The delay deadlines with respect to the Register of Sales and Revenues and the Register of Electronic Purchases of Annex II of Superintendency Resolution No. 269-2019/SUNAT for the month of February 2020, are extended as follows:

iii) The deadlines with respect to the tax related books and records that are kept physically (Resolution No. 234-2006/SUNAT) and electronically (Resolution No. 286-2009/SUNAT) -which originally expired between March 16, 2020 and May, 2020- was extended until June 4, 2020.

iv) The delivery deadlines for submission to SUNAT, directly or via OSE where applicable, of information statements and communications from the Electronic Issuing System, -which originally expired from March 16, 2020 until April 30, 2020- were extended until May 15, 2020.

v) The deadline for submitting the Annual Declaration of Transactions with Third Parties (DAOT),-which originally expired from March 16, 2020 to March 31, 2020- was extended until May 29, 2020.

vi) It is ordered that these new expiration dates will be applied in order to establish the deadlines that taxpayers have to submit a request for the refund of credit balance in favor of the benefit from March or later months.

B.For taxpayers receiving third category income, who in the taxable year 2019 have earned anet income of up to 5,000 Tax Units (S/ 21,000,000.00)or who have obtained or received revenues other than third category income, which added up do not exceed such amount:

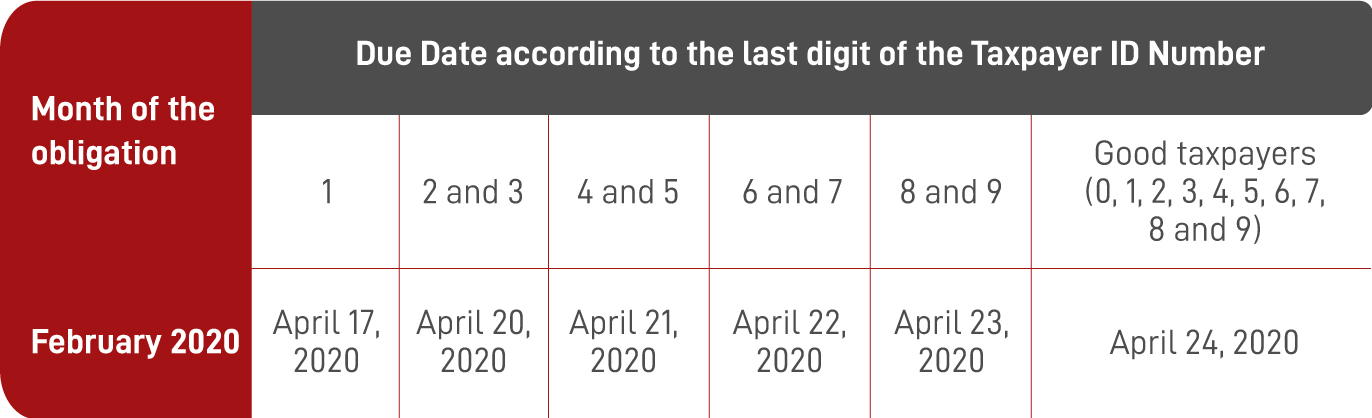

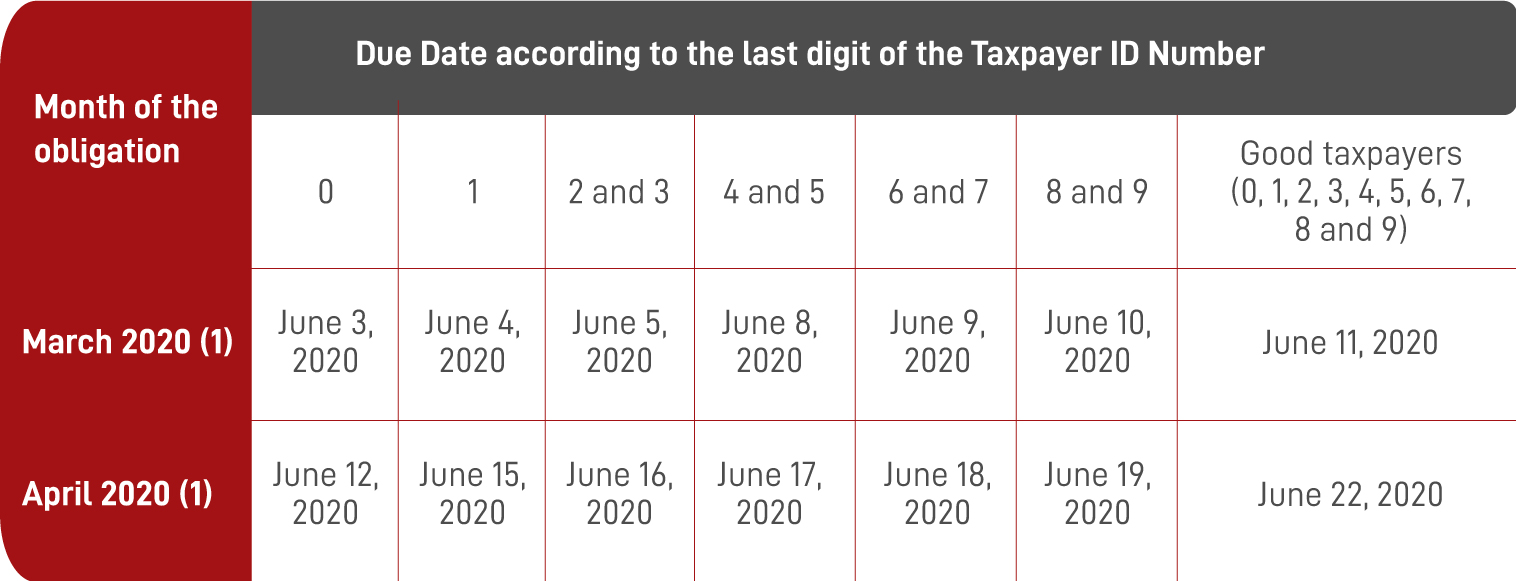

i) The deadlines for the declaration and payment of the monthly tax obligations for the months ofMarch and April 2020(except those declared through PLAME), are extended as follows:

(1) The deadlines for the tax return and cash payment or the installments of the Net Assets Tax (ITAN) are included.

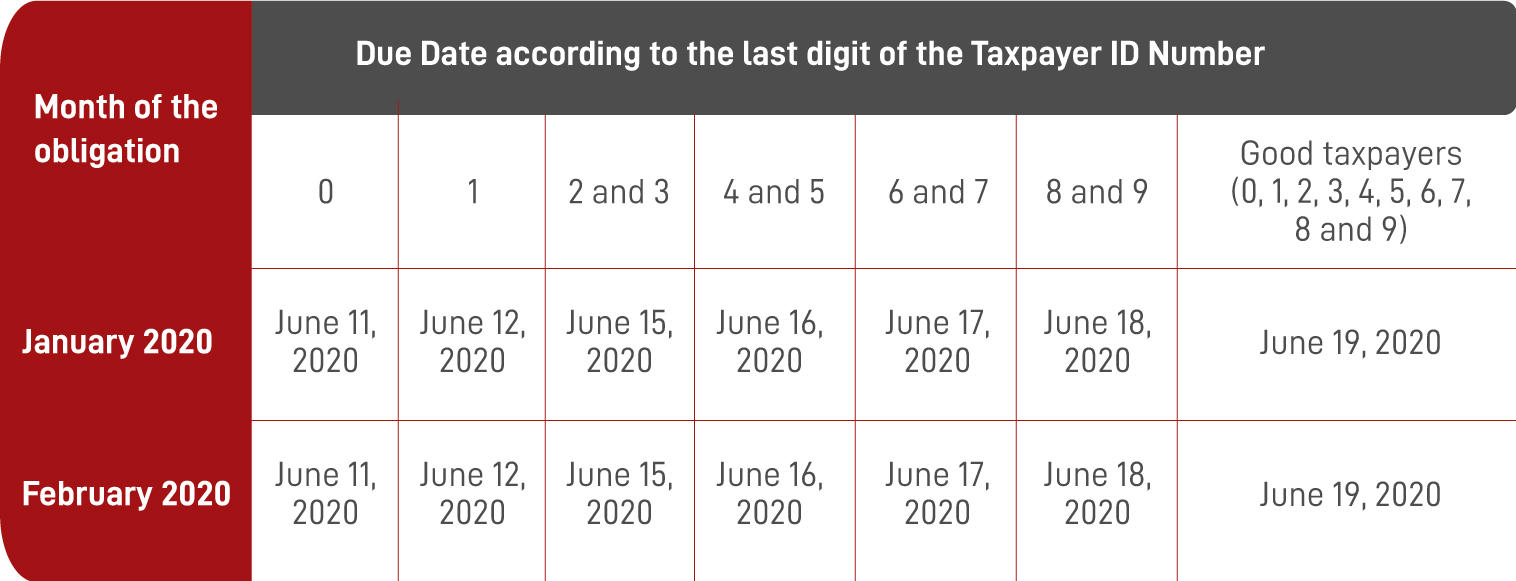

ii) The deadlines with respect to the Register of Sales and Revenues and the Register of Electronic Purchases of Annex II of Superintendency Resolution No. 269-2019/SUNAT (applicable to taxpayers obliged to keep books electronically from 2020) for the months of January and February 2020 are extended, as follows:

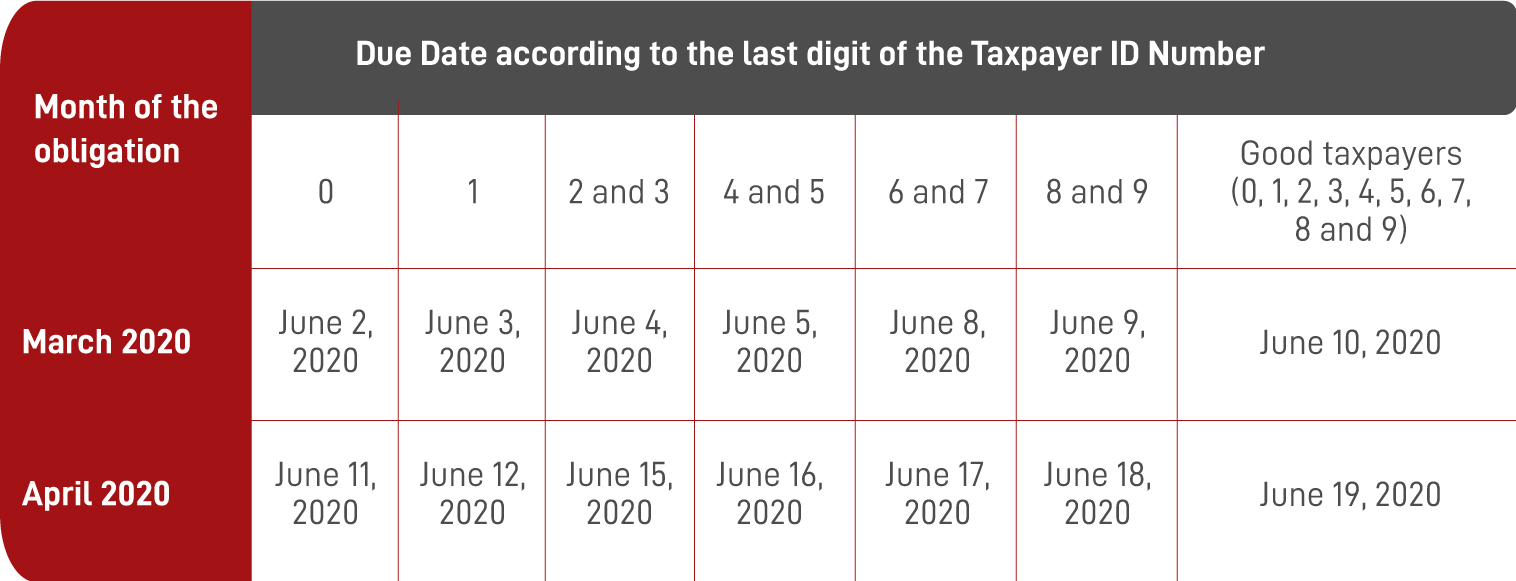

iii) The delay deadlines with respect to the Register of Sales and Revenues and the Register of Electronic Purchases of Annex II of Superintendency Resolution No. 269-2019/SUNAT (applicable to taxpayers who have already voluntarily or were obliged to keep electronic books before 2020) for the months of March and April 2020, are extended as follows:

C. For taxpayers receiving third category income, who in the taxable year 2019 have earned anet income greater than 2,300 Tax Units (S/ 9,660,000.00) and up to 5,000 Tax Units (S/ 21,000,000.00)or who have obtained or received revenues other than third category income, which added up do not exceed such amount:

i) The delay deadlines with respect to the tax related books and records that are kept physically (Resolution No. 234-2006/SUNAT) and electronically (Resolution No. 286-2009/SUNAT) -which originally expired between March 31, 2020 and May 2020- are extended until June 4, 2020.

ii) The delivery deadlines for submission to SUNAT, directly or via OSE where applicable- of information statements and communications from the Electronic Issuing System, -which originally expired from March 31, 2020 to April 30, 2020- are extended until May 15, 2020.

iii)The deadline for submitting the Annual Declaration of Transactions with Third Parties (DAOT), – which originally expired from March 31, 2020 to April 30, 2020- was extended until May 29, 2020.

iv) It is ordered that these new expiration dates will be applied in order to establish the deadlines that taxpayers have to submit a request for the refund of credit balance in favor of the benefit from March or later months.

The extensions referred to in paragraphs B and C above also apply to those persons who are not subject to income tax, other than the National Public Sector.

Tax deferral and/or differ payment.- The same Superintendency Resolution orders that for all tax debtors who were granted a tax deferral and/or differ payment benefit that is in force until March 15, 2020 (including major taxpayers), the installments that become due on March 31, 2020 and April 30, 2020 that are not paid on a timely manner shall not be considered for the loss of the tax deferral and/or differ payment benefit if they are paid untilMay 29, 2020, together with the corresponding default interests.

Default interest rates on tax debts and refunds are reduced.- Superintendency Resolution No. 066-2020/SUNAT, published on March 31, 2020, establishes that from April 1, 2020:

i) The Default Interest Rate (TIM) applicable to domestic currency tax debts will be 1% per month; and in foreign currency, 0.50% per month.

ii) The interest rate for refunds in domestic currency that are made for undue or excess payments, will be 0.42% per month. This rate shall not apply to undue or excess payments that are made as a result of a payment order issued by the Tax Administration, nor to the refund of withholdings and collection of IGV.

iii) The interest rate for refunds of undue or excess payments in foreign currency is 0.25% per month.

Disposition of balances of the SPOT account.- Superintendency Resolution No. 067-2020/SUNAT, published on March 31, 2020, establishes new dates to request the free disposition of the amounts deposited in the detraction accounts:

i) The requests for the release of funds originally due by April 3, 2020 will be submitted between April 8 and 14, 2020.

ii) The requests for the release of funds originally due by April 7, 2020 will be submitted between April 8 and 16, 2020.

A new extension of the deadlines for the submission of the PLAME is established.- Due to the extension of the State of National Emergency until April 26, 2020, through Superintendency Resolution No. 069-2020/SUNAT, published on April 13, 2020, new due dates are established for the declaration and payment of the amounts contained in the PDT Electronic Sheet - PLAME, Virtual Form Nº 0601:

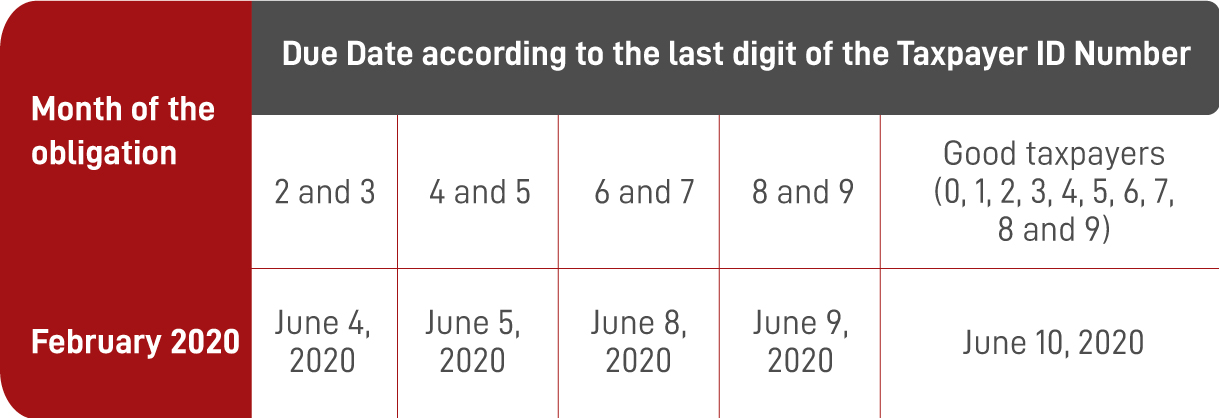

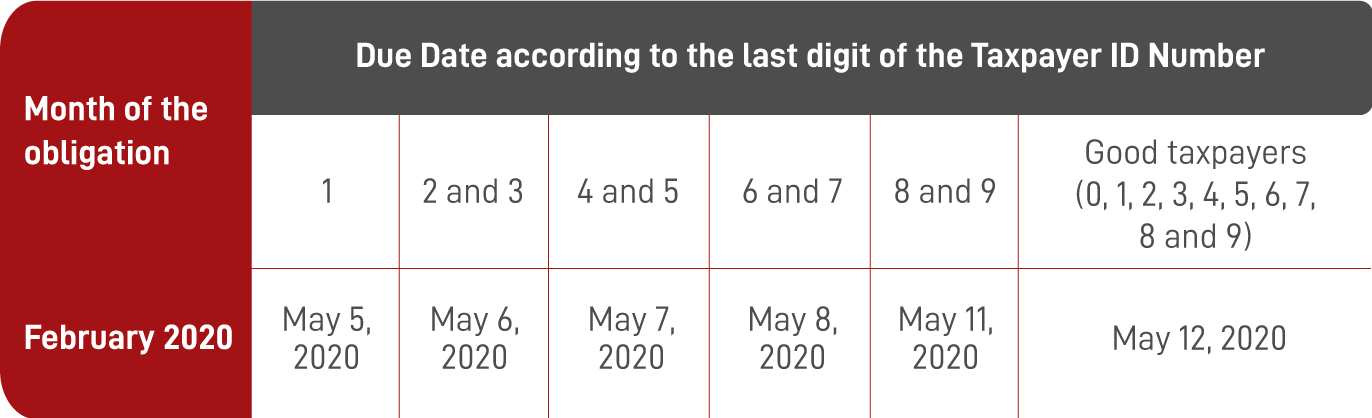

A. For taxpayers receiving third category income, who have earned a net income of up to 2,300 Tax Units (S/ 9’660,000.00) in taxable year 2019 or who have obtained or received revenues other than third category income, which added up do not exceed the amount above, the deadlines for February 2020 are extended as follows:

B. For taxpayers receiving third category income, who in taxable year 2019 have earned anet income of up to 5,000 Tax Units (S/ 21’000,000.00)or who have obtained or received revenues other than third category income, which added up do not exceed such amount, the due dates for the month ofMarchare as follows:

Dates of payment of taxes in the Metropolitan Municipality of Lima are amended.- The Agreement of the Steering Council in its Ordinary Session No. 332, has modified the deadlines for the payment of the second, third and fourth instalments of year 2020 corresponding to the Property Taxes, Municipal Taxes and Vehicle Property Taxes, establishing as new due dates for those installments: July 31, 2020, September 30, 2020 and November 30, 2020, respectively.

Additional deduction for expenditure on scientific research, technological development and technological innovation projects established in Law No. 30309.- Through Supreme Decree No. 056-2020-EF, the Regulation of Law No. 30309 is adapted to the amendments introduced by Emergency Decree No. 010-2019, which established new additional deduction percentages (50%, 75% or 115%) based on the net income received by the taxpayers.

For this purpose, it is foreseen that the net income and Tax Unit of the taxable year subject to the deduction will be considered and that taxpayers beginning activities in the taxable year will consider the net income and the Tax Unit for such year.

Indirect Income Tax credits paid by first and second level foreign companies.- Paragraph f) of Article 88 of the Income Tax Law provides that, in order to be entitled to the tax deduction, the dividends or profits distributed, SUNAT must be informed of the taxpayer’s shareholding and the amounts of the profits obtained.

For these purposes, Superintendency Resolution N° 059-2020/SUNAT approves the following forms:

- Annex I: Communication on the shareholding in foreign companies.

- Annex II: Communication on the profits obtained by the non-domiciled first and second level companies, and the dividends distributed by them.

It is also foreseen that once the registration of the information required has been completed, such forms will be printed and signed by the legal representative of the legal entity and sent in PDF format to the following email address: [email protected]. The communications will be sent within the same timeframes established for the submission of the Annual Income Tax Return.

Procedure for the refund of the excise tax (ISC).- Emergency Decree N° 012-2019 established that certain transportation companies may request the refund of 53% of the ISC that is part of the selling price of B5 and B20 diesel, corresponding to the acquisitions made from January 1, 2020. Then, Supreme Decree No. 419-2019-EF established, inter alia, that the tax refund request will be submitted on a quarterly basis for a minimum amount of one (1) Tax Unit.

In this context, Superintendency Resolution N° 057-2020/SUNAT establishes the following:

i) The transportation company must submit Form No. 4949 to any SUNAT front office, together with the supporting documentation in a USB memory device or a compact disc.

ii) The information submitted must be validated via the information technology platform “PVS: SUNAT Validator Program”, which will be available from April 1, 2020.

iii) On March 31, 2020 at the latest, SUNAT will publish the list of transportation companies that are the beneficiaries of the Fuel ISC refund, as well as the refund amount corresponding to each beneficiary.

NATIONAL CURRENT NEWS

Investment Fund.- Report N° 016-2020-SUNAT/7T0000 establishes that in the case of an investment fund constituted in Peru that obtains financing through the issuance and placement of bonds via private or public tenders in Peru and charged to the fund, and that invests the cash thus obtained in the investment portfolio (shares and bonds) and generates foreign income:

- The interests obtained by the acquirers of such bonds are qualified as Peruvian source income.

- The administrator of such fund can deduct the interests derived from the bonds for determining the foreign source income attributable to the participants when distributing the profits.

Determination of Third Category Income.- Through Report N° 025-2020-SUNAT/7T0000, the following was established:

- If after the granting of a pledge but before its execution, the goods that support such pledge suffer a loss or impairment that reduces the likelihood of recovery of the initial secured amount, the amount of the loss or impairment of such goods is not deductible as a provision for doubtful accounts.

- The debts included in a Restructuring Plan or in a Global Refinancing Agreement approved in accordance with the provisions of the General Bankruptcy Law, are not deductible as provision for doubtful accounts.

Value Added Tax (IGV): Implications of Transfer Prices.- Report N° 022-2020-SUNAT/7T0000 establishes that the adjustments made to the market value of the services provided by related companies by applying the transfer pricing methodology for IGV purposes are not applicable to establish the market value of a services whose value is not reliable for IGV purposes.

CASE LAW

Change of grounds for the objection (RTF N° 00878-4-2020).- During the audit, SUNAT objected the expenses for extraordinary bonuses by claiming that the taxpayer violated the criteria of proportionality and reasonableness when allocating amounts higher than those indicated in the memorandums it submitted. However, when issuing the assessment resolution, the Tax Administration based the objection on the breach of the principle of generality, since the taxpayer did not grant the aforementioned bonuses to all of its workers with the same higher hierarchical level.

The Tax Court concluded that the change of grounds established that the objection was not correctly substantiated and therefore the objection was closed and the resolution appealed in this regard was revoked.

Tax credit for management and administration services contracted by a consortium (RTF No. 04857-4-2019).- The Tax Administration questioned the tax credit corresponding to expenses for management and administration services, stating that these services were not necessary to generate income or maintain the income generating source, as they were part of the tasks of the consortium members.

The Tax Court stated that for the correct operation of a consortium or any other business, it was reasonable and necessary to contract management and administration services, which must be substantiated by the respective supporting documentation. In addition, the causality of the operation was confirmed with the minutes of meeting of the Administrative Technical Committee of the Consortium, in which the Committee was assigned with the task of evaluating and taking action on the progress of the work, the implementation of measures to increase investments in the work, as well as the decision-making on the organization of the consortium, the payment of invoices and the management of the treasury.

Link to article

Post a comment

Post a comment Print article

Print article