In a new geopolitical reality Norway’s natural gas and renewable energy resources will be vital to Europe’s energy transition

Dramatic changes to energy supply security driven by geopolitical upheaval

The EU energy transition is aimed at weaning Europe of its fossil fuel dependence and to enable Europe to reach climate emissions reduction targets.

For the last 100 years, energy consumption other than transportation has been supplied almost entirely by hydropower. Norway in later years has been actively reducing its dependence on fossil fuel for road transport, costal shipping and the offshore supply fleet. Domestic consumption of natural gas is insignificant.

On 24 February 2022, the energy supply situation in Europe changed dramatically. EU decided in the following weeks a massive reduction in Russian natural gas imports, until then amounting to approx. 155 Bcm a year. Germany ultimately mothballed the Gazprom controlled Nord Stream 2 pipeline project.

EU is planning to compensate the reduction in Russian volumes by reducing consumption, securing new suppliers, switching fuels and accelerating investment in renewables. The EU and NATO allies urged Norway and other energy exporters to increase production to mitigate the remaining shortfall.

Norwegian intermediate actions – deviating from its petroleum resource management policy

The Ukraine crisis makes the energy transition more urgent for all of Europe. Norway as a major energy exporter and EEA member state must be part of the solution for the Europeans. So far, Norway has committed to stay a major long term, predictable and substantial natural gas supplier. Norway also exports hydropower generated electricity, but at a much smaller scale. Norway, however, also has to contribute to the European energy transition in other ways. This will require several policy changes, some of which are already in «the pipeline», some necessarily to be taken in the near future.

The urgency of the situation requires a change in policy that may increase and sustain larger natural gas volumes exported from Norway. An immediate first step by Government was to enable increased natural gas volumes to Europe. It was implemented by deviating from its 50-year petroleum resource management philosophy by adjusting production permits of three large offshore fields. Policy and statutory requirements up till now have obliged concessionaires to maintain optimal reservoir pressure to ensure maximum liquids depletion before permitting pressure reduction through natural gas extraction. The system had successfully ensured a liquids depletion rate of close to 50% in average.

The production permits allow increased and faster natural gas outtake than previously, ultimately, leaving more crude oil in the ground.

With the new permits in hand, Norwegian natural gas export will remain at the limit of infrastructure capacity. Currently Norway annually exports in excess of 115 Bcm by pipelines or approx. 25% of European consumption. Snøhvit LNG in the Barents Sea is scheduled back on stream this summer after a nearly two years outage caused by fire. Snøhvit may deliver approx. 3,6 mmpta of LNG. To export additional volumes requires further optimisation of existing infrastructure, including processing facilities and landing pipelines and developing new production projects. Industry commentators consider it possible that the total increase may amount to approx. 20 Bcm annually in a not too distant future.

Increased natural gas production without increasing emissions

Increased volumes of Norwegian natural gas substituting Russian natural gas or LNG imports from other resources to Europe may assist in the overall reduction of emissions. Simultaneously, increased electrification of Norwegian offshore production will reduce the Norwegian carbon footprint. Regardless of whether Norway increases production or not, to meet its climate change commitments it will have to reduce substantially its emissions from petroleum production and natural gas supply to Europe.

To date, electrification of offshore production has been supplied by electricity generated by onshore hydropower substituting offshore gas-fired generators. It is delivered offshore by submarine cables connected to the national grid. The push for offshore electrification remains unabated even though some have raised concerns about the effect of domestic prices with the current source of supply. Increases in electricity supply to offshore projects has contributed to the supply squeeze in southern and western Norway, resulting in skyrocketing consumer prices. Adding renewable capacity to the grid as well as form offshore proposes will have to be realised relatively quickly. Otherwise, the domestic market shall continue to suffer electricity prices at par with Europe.

An increase in future Norwegian electricity production

The potential for increased Norwegian production of hydropower is relatively limited. By the Norwegian Energy Directorate estimated to be no more than 6-8 TWh. The unpopularity of onshore wind farms caused by rapid development had lately made it nigh impossible to move swiftly forward in this field. Three options appear open to provide additional electricity to supply strapped regions. Firstly, increasing the transmission capacity from the northern to the southern regions and gearing up offshore wind projects. Secondly, swifter development of offshore wind. Thirdly, revisit sanctioning onshore wind projects previously held back, combined with additional domestic transmission capacity.

Norway has maxed out its European electricity interconnector capacity. At the moment, there is barely any inflow. Before the Ukraine invasion (called by Russia a special military operation), this had caused political upheaval in Norway, leading to shelving plans for new interconnectors, including any hybrid cables for contemplated offshore wind projects.

Offshore wind power in a sea of change

With the dramatic developments in the European energy and security situation, it is obvious that political Norway has started to think differently. Following cabinet reshuffle earlier this month there are also indications that other elements are up for re-evaluation.

The original offshore wind policy required adoption of additional legislative instruments. With a 20 August 2021 deadline, the previous Government circulated for public comment proposals for amendments to the Offshore Energy Act (Havenergilova) and regulations (Havenergilovforskrifta). The new minority centre-left Government that came to power in September 2021 reconfirmed its intention to pursue a system with prequalification and auctions as drawn up in the circulated consultation document by the previous Government. Ministers also confirmed the intention to submit to Stortinget during this spring session a proposal for amendments to legislation, but no such proposals have been tabled yet.

Reconsidering the criteria for offshore wind awards

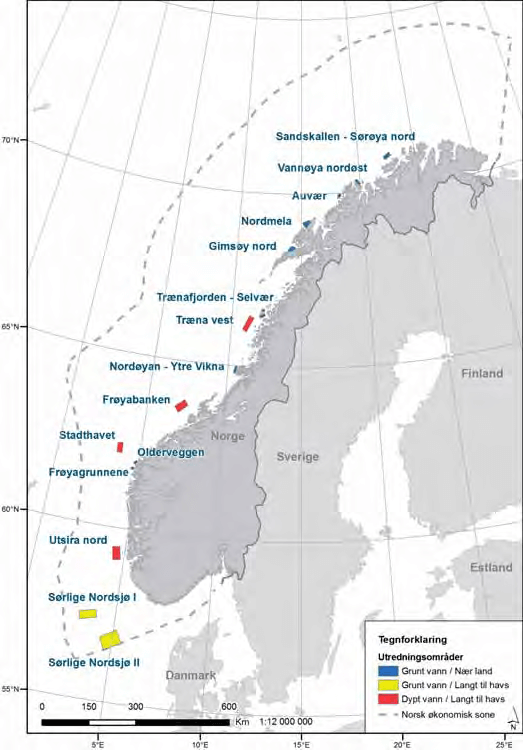

On 23 March 2022, the new Energy Minister announced that Government has reconsidered and partly changed the concession award criteria for one of the announced areas dedicated to offshore wind. While the initial auction system will remain in place for Sørlige Nordjø II[1], a petroleum regime like award approach based on objective, qualitative non-discriminatory conditions will be applied to Utsira Nord[2]. Unlike Utsira Nord, the water depth in Sørlige Nordjø II allows for fixed installations. Only prequalified entities are eligible as concessionaires. No changes seem to be imminent with regard to prequalification for either area.

Government’s aim with the Utsira Nord system is to support technological development and innovation contributing to cost reduction associated with floating power production facilities. An auction model is considered unfit for this purpose. The Minister stressed that he expects offshore wind to be an important contribution to increased renewable energy globally. He also expects it to assist domestic supply and the Norwegian energy transition, as well as increase capacity and competence in the Norwegian offshore energy cluster. It also likely to create new job opportunities in Norway.

Regardless of the award approach, in both areas the result will be the award of (one or more) concessions. A concession of this type under Norwegian law, entails a conditional administrative decision. By the concession the concessionaire obtains a time limited right (in this case an exclusive right) to construct, operate and use facilities and conduct specific activities pursuant to identified material obligations or terms for operations to be conducted. The approach was refined through the development of the system adopted in the upstream petroleum production regime. This regime was historically inspired by the onshore hydropower production concessionary regime allowing public and private entities to exploit waterfalls, but not through the concessions obtain property rights to the waterfalls themselves.

Statnett, offshore cables and the controversy of hybrid solutions

So far, there are no changes in attitude with regard to hybrid cables in connection with offshore wind farms. These cables would allow electricity generated to connect to the Norwegian grid, as well as function as interconnectors allowing both export and import. With current supply constraints in Europe it was feared that this would result in offshore windpower being only for export and not mitigate domestic renewable energy needs.

The Government has now decided that Statnett shall be in charge of planning the offshore cable network. Statnett is the state’s wholly owned electricity transmission grid owner and system operator. To put Statnett in charge was desirable according to the Minister to ensure appropriate integration with the onshore grid, to which existing interconnectors are connected.

Complex regulatory environment

A multitude of legislation applies to energy generation in Norway. The purpose of power projects and the way electricity shall be used or consumed may determine the regulatory environment of the project. The Offshore Energy Act governs offshore renewable energy production and use. That comprises more than wind power. This law does not govern energy generation and use from windmills if the electricity is for upstream petroleum production and offshore petroleum utilisation purposes. Unless otherwise decided by Government, such projects will be subject to the 1996 Petroleum Act. The upstream petroleum regime will apply i.e. to electricity generation from offshore wind constructed as part of a production project or when the power from such facilities, is solely dedicated to fixed or floating petroleum production installations.

Projects governed by the Offshore Energy Act will be subject to the general tax act on income and capital gains (GTA), not the special upstream petroleum tax regime applicable to upstream petroleum and offshore utilisation projects. Working environment, health and safety regimes are also differently regulated onshore and offshore. The onshore electricity regulating regime and the GTA applies to electricity generated Norwegian territory inside maritime base lines established pursuant to public international law and Norwegian statutory provisions.

Way forward

Initiatives mentioned above cannot be the last, more must come, and soon. Utsira Nord and Sørlige Norsjø II are among pundits considered insufficient If Norwegian offshore wind is to play a factor in substantially reducing Norwegian electricity prices or supplement European supply needs. Additionally, the announcement of Utsira Nord qualitative award criteria is still pending and the timeline of new acreage offers have not changed.

In the age of energy transition, the Russian invasion of Ukraine imposes an additional shock to the European perception of energy security. It likewise exacerbates the pressure on Norwegian electricity supply to Norwegian consumers, as well on the plans to electrify offshore petroleum production and transportation. It may force Norway to reconsider not only offshore wind, but also onshore wind. Onshore wind is still controversial because of the process associated with initial developments. This will have to be overcome.

In his speech to the National Executive Committee of the Labour Party broadcast directly in the afternoon of 29 March, the Norwegian Prime minister Mr. Støre, confirmed the above. In his speech, he outlined that it is the Government’s intention is to ensure that Norway will remain a substantial and dependable supplier of natural gas to Europe to mitigate the fall out of the Ukraine crises and to assist the European energy transition to renewables. Norway will continue the electrification of Norwegian upstream petroleum production and transportation facilities. This will support reduction of EU, as well as Norwegian emissions. The new energy reality combined with the need also for a Norwegian energy transition would require Norway looking into all potential renewable energy generating activities, including both offshore- and onshore wind, as well as solar power.

[1] Sørlige Nordsjø II defined by the following coordinates: 4° 20′ 48″ E, 56° 49′ 24″ N;5° 10′ 05″ E, 57° 05′ 36″ N;

5° 29′ 51″ E, 56° 44′ 17″ N; 5° 02′ 01″ E, 56° 35′ 30″ N and 4° 38′ 29″ E, 56° 29′ 02″ N.

[2] Utsira Nord defined by the following coordinates: 4° 16 ’09» E, 59° 26′ 53″ N; 4° 40′ 25″ E, 59° 28′ 56″ N; 4° 24′ 27″ E, 59° 04′ 10″ N and 4° 48′ 44″ E, 59° 06′ 18″ N.

Link to article

Post a comment

Post a comment Print article

Print article