Thai Civil and Commercial Code Amendment: Introduction of Merger Scheme and Flexibility for Corporate Governance of Limited Companies

This article highlights key elements of the Amendment Act, as well as comparisons with the existing provisions under the TCCC and the implications for business operators.

Key Elements of the Amendment Act

The groundbreaking changes proposed under the Amendment Act can be divided into three major aspects as set out in the following table.

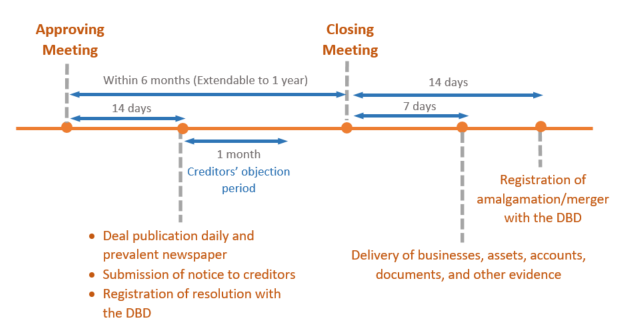

Subsequent to the Approving Meeting and publication of the notice of amalgamation/merger, the Amendment Act requires a shareholders’ meeting to consider the corporate particulars (the “Closing Meeting”), such as the name, objectives, Articles of Association, and the number of shares of the amalgamated/merged entity. In this case, the Closing Meeting must be held within six months from the date of the Approving Meeting, extendable for up to one year with approval from the Closing Meeting pursuant to the addition of Section 1240/1.

Directors of the consolidating entities are required to deliver their respective company’s businesses, assets, accounts, documents, and other evidence to the board of the amalgamated/merged entity within seven days from the Closing Meeting date and register the completed deal with the DBD within 14 days as from the Closing Meeting date for post-merger integration according to Section 1241. The new company will acquire all the consolidating entities’ property, obligations, rights, and liabilities from such registration, and each consolidating entity shall cease to have the status of a juridical person.

Diagram: Timeline Conveying Compliance Procedure for Merger and Amalgamation Execution pursuant to the Amendment Act

Concluding Remarks

Despite the fact that the process appears to be getting easier for business operators, whether in terms of incorporation, operation, or consolidation, there still remain ambiguous elements pursuant to which operators who intend to follow these regulatory changes shall remain at risk.

-

- Absence of Official Interpretation

Section 1240 prescribed that the resolution for merger and amalgamation must be published in a ‘daily newspaper which is widely available’. The source of publication stated in such clause differs from Section 1175, which states that the notice of the general meeting must be published in a ‘local newspaper’. There is no specific definition for such two phrases that interprets the difference or the qualifications by which to ascertain brands or media companies as a sufficiently widely distributed newspaper. Therefore, it will depend on the official interpretation in this regard and may affect the legal compliance on publishing notices for merger and amalgamation.

-

- Absence of Enforcement of Other Authorities

Merger and acquisition transactions involve numerous aspects for consideration as well as dealing with different public authorities. Therefore, tax analysis is another essential step when conducting due diligence prior to deal closure. While there have been multiple rulings pertaining to tax liabilities in the course of share acquisition, asset acquisition, and amalgamation, which facilitates calculation to reduce tax exposure upon deal execution, the Thai Revenue Department is still silent upon the merger scheme under the Amendment Act.

-

- Limited Legal Recognition of Electronic Corporate Conduct

While the Amendment Act permits the holding of BOD e-Meetings, this legal recognition does not extend to permitting the same for shareholders’ meetings. This legal development is contradicted by the recent amendment to the Public Company Act, effective on 24 May 2022, which allows board meetings and shareholders’ meetings, including submission of related notices therefor, to be conducted electronically.

Ultimately, this Amendment Act is another significant step forward in developing Thailand’s corporate regulatory regime. We now must monitor this significant legal development, as well as the relevant subordinate laws and the establishment of corporate penalties in the event of non-compliance, which are expected to be enacted in subsequent amendments.

For more information, please get in touch with our corporate and M&A Team, or alternatively, please contact the authors.

Kudun and Partners’ corporate and M&A practice

Kudun and Partners is at the forefront of this growth in Thai and regional activity. Our team of widely recognized lawyers has worked on many of the region’s largest deals, as well as providing crucial corporate advisory services. We distinguish ourselves by our responsive, client-focused approach and commercial acumen and are committed to developing a deep understanding of our client’s goals and objectives.

The post Thai Civil and Commercial Code Amendment: Introduction of Merger Scheme and Flexibility for Corporate Governance of Limited Companies appeared first on Kudun.

Link to article

Post a comment

Post a comment Print article

Print article