Private Equity – Where Next?

As a worldwide asset class private equity has seen more uncertainty than most over recent years. It is now more than four years since the calamitous collapse of the global economy and over that period private equity has continued to lack direction.

Since its pioneering days of the 1970s and 1980s and through the leverage fuelled 1990s and 2000s private equity has seen more than its fair share of spectacular successes. The returns generated saw fund managers flocking to the unquoted segment with a real belief that private equity should form a key part of a balanced strategy. All was well with the world and private equity practitioners and the management teams they supported were rewarded handsomely. Yet for the last three years the private equity market has been at best flat. Cynics will argue that the lack of worldwide leverage has caused the flow of deals to dry up. This is overly simplistic, and while perhaps true at the very largest deal level ignores a number of other drivers. So as we see signs of recovery in the USA and more recently the UK it seems pertinent to ask – What next for private equity?

A return to deals?

It is fair to suppose that the limited partners who provide funds to private equity houses are nothing other than rational value maximising investors. An allocation to private equity is as commonplace as fixed income or bonds but with it comes an expectation of activity and crucially returns.

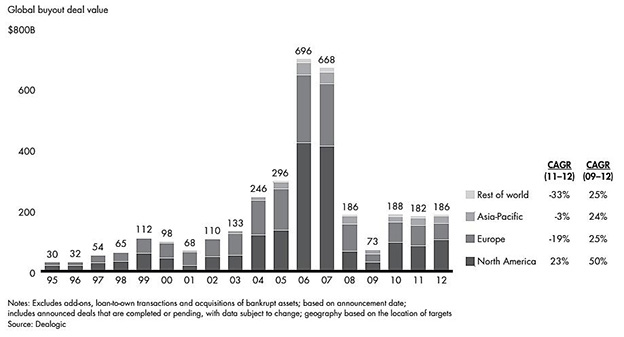

It is far from easy to draw a unified global conclusion on activity trends. In Europe there are signs of recovering volumes in the north whilst the south has some way to go. In North America 2012 saw activity levels increase by 23% (Source Grant Thornton). Whilst the base level was low this improvement demonstrates the clear and obvious linkage with the macro-economy. In Asia trends have been less clear. Again the (relative) cooling of growth forecasts of China has put the brakes on a GDP fuelled deal fest. The same was also true for India in early 2012 albeit recent activity levels have looked more positive.

At a macro level it seems that the talk of cautious optimism is well founded. Whilst the boom days of the early 2000s will remain a distant memory, there is hope for an improvement in deal volumes as the global economy strengthens.

A time to exit?

If the case around new investments is one of cautious optimism then what about the routes to realising value for existing investments? For private equity funds their life blood is fund raising and the timing and quality of exits are perhaps the only real driver of their ability to raise the next fund. So where will they look?

IPO? – Public equity markets have themselves begun to demonstrate real optimism in 2013. Their previous flatness effectively meant they were simply not open as an exit route. Across the globe this tide is turning and private equity houses are at the front of the queue. The recent high profile float of Merlin (a global theme park operator) hot on the heels of that of Foxtons (a property agent) have demonstrated the confidence in the London Stock Exchange.

Sale to trade?-Whilst corporates have focussed on deleveraging their balance sheets and building cash balances over the last five years there are signs of change across the globe. The halcyon days of fierce trade auctions over any asset (almost regardless of its quality) will not return. That said for a strategically valuable business properly positioned and well-built there are once again signs of increased demand.

The secondary deal?- Perhaps the most intriguing facet of the private equity market in recent years has been the development of the secondary and tertiary deal. In 2012 secondary deals accounted for 29% of global private equity deals (source: Bain). Whilst some might argue that the secondary deal suggests a lazy private equity house or indeed an unsalable asset this is far from reality. How can a portfolio company produce great returns in its third or fourth private equity incarnation? An academic study by PERACs suggests that while absolute returns are marginally lower on secondary deals it is not always the first owner that makes the biggest return. Furthermore secondary deals have a far lower variation in returns and hence are less risky. Intuitively it is easy to see that a private equity backed business should have an incentivised and capable management team with strong governance and control systems which should reduce risk.

A sector focus?

Private equity has long looked to call early those sectors with real prospects. Houses have searched hard for those segments of the economy with particular technological or regulatory drivers of both growth and consolidation. In many ways investors would argue that they are often developing new products or markets to such an extent that they become compelling exit targets for the more risk averse corporates. Technology is clearly the long standing example of such a sector.

Recent years have seen strong growth in those regulatory driven markets around the public sector. Healthcare is just such a segment. The burgeoning world population means that across the globe governments are looking for innovative and efficient models to meet demand. Healthcare transactions have also traditionally lent themselves to another favourite deal type – the roll-up or buy and build where the private equity house makes a platform acquisition followed by a series of bolt-on deals building value both via growth but also in price arbitrage.

So what does this all mean?

As 2013 draws to a close the global private equity market seems to be cautiously optimistic. As the world economy recovers (albeit at different rates there is a sense of increasing deal volumes both on entry and exit).

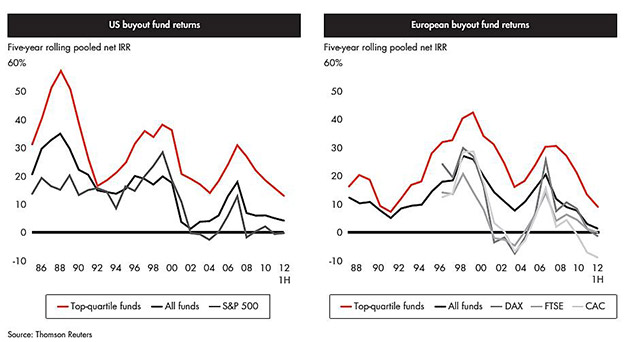

With trade sales, IPOs and secondary deals all on an upturn then good investors will be able to drive exits and ultimately raise further funds. Their ability to deploy those new funds will be assisted by the improvement in debt markets. Amid all this navel gazing and introspection it is worth remembering that underlying returns on PE investments across the globe continue to outperform public markets over a 5 year time horizon.

The core fundamentals of private equity investment around incentivising high calibre managers to deliver in fast growth and rapidly changing markets are as strong as ever. The rough ride over the last few years has seen the strongest most effective private equity fund managers come to the fore. With the benefit of GDP growth those managers should see enhanced returns and further funds will be forthcoming. Private Equity has grown up!

Footnotes: Simon Ward Partner - Springboard Corporate Finance www.springboardcf.com Springboard is a UK based Investment banking firm operating from Birmingham and London. We focus on M&A transactions in the $10m-$100m range. Our partners all have extensive experience of private equity transactions both as advisors and principals. Notable deals in the last quarter include the MBO of Equiom (an off-shore trust administration business) and the sale of Indecs Computer Services (An IT services provider). |

Post a comment

Post a comment Print article

Print article