Relief From Transfer Pricing For Controlled Foreign Companies

The current transfer pricing provisions contained in section 31 of the Income Tax Act, 58 of 1962 came into effect on 1 April 2012 and are applicable for years of assessment commencing on or after that date.

In terms of section 31(2), where:

- any transaction, operation, scheme, agreement or understanding constitutes an “affected transaction” and

- any term or condition of that transaction, operation, scheme, agreement or understanding is:

- different from any term or condition that would have existed had those persons been independent persons dealing at arm’s length; and

- results or will result in any “tax benefit” being derived by a person that is a party to that transaction, operation, scheme, agreement or understanding the taxable income or tax payable by any person that derives a tax benefit must be calculated as if that transaction, operation, scheme, agreement or understanding had been entered into on the terms and conditions that would have existed had those persons been independent persons dealing at arm’s length. The re-calculation of the taxable income or tax payable is referred to as the primary adjustment.

In terms of section 31(3), to the extent that there is a difference between:

- the arms’ length amount that is applied in the calculation of the taxable income of any resident that is a party to an affected transaction; and

- any amount that would, but for the arms’ length amount, have been applied in the calculation of the taxable income of the resident,

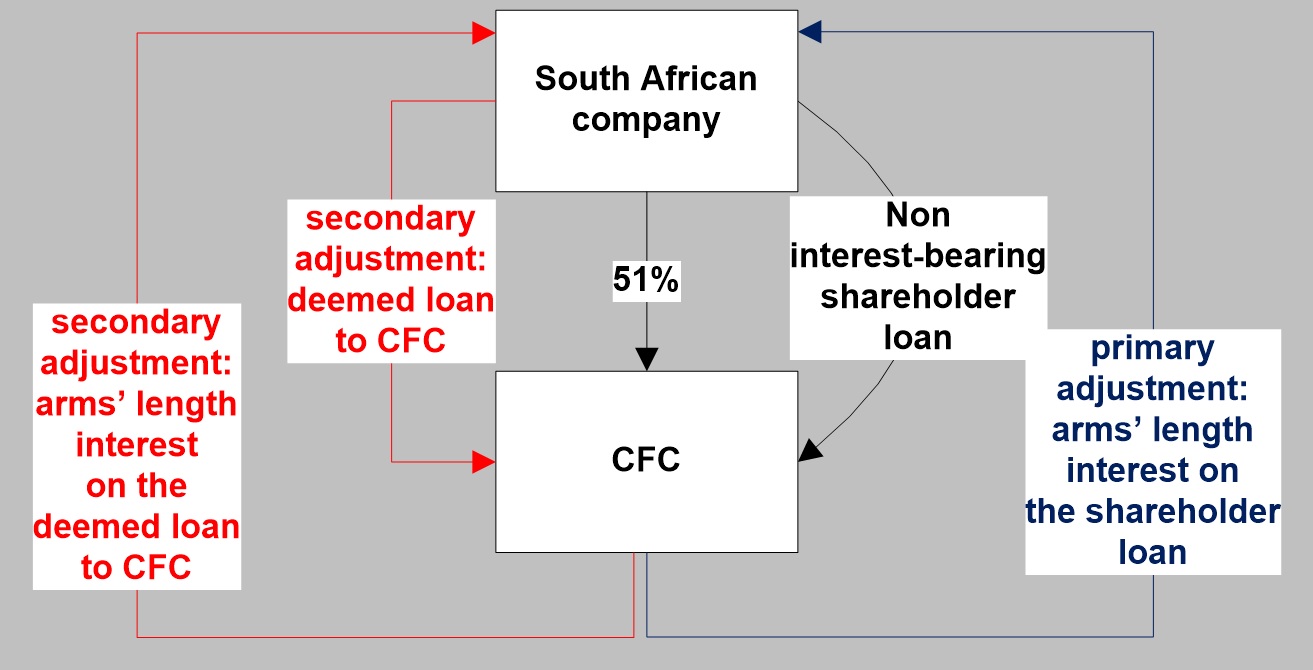

the amount of that difference must be deemed to be a loan that constitutes an affected transaction. The deemed loan is referred to as the secondary adjustment. As this deemed loan will also constitute an affected transaction, it will attract interest at an arm’s length rate.

Accordingly, where a South African company makes an interest-free shareholder loan to its “controlled foreign company” or “CFC” with no fixed date of repayment, the provisions of section 31 would apply to the South African company and the South African company will be required to calculate its taxable income as if the shareholder loan had been entered into on terms and conditions that would have existed between independent persons dealing on an arm’s length basis. The South African company would therefore be required to make a primary adjustment by including in its taxable income interest at a rate equal to an arms’ length interest rate on the shareholder loan to the CFC. The South African company would further be required to make the secondary adjustment by including in its taxable income an amount of interest calculated at an arms’ length interest rate on the deemed loan until it is repaid.

In accordance with the Explanatory Memorandum on the Taxation Laws Amendment Bill, 2012 these types of shareholder loans (i.e. non interest-bearing interest and with no fixed dates of repayment) often operate as an inherent form of share capital and are therefore an important method of indirectly funding offshore start-up operations.

However, because of the application of section 31 to such interest-free shareholder loans, the South African company will be subject to income tax on the notional primary and secondary adjustments, whilst the CFC will, in all probability, not be allowed a deduction for the notional primary and secondary adjustments. The net result is a potential double taxation which reduces the international competitiveness of South African multinationals.

In order to facilitate the expansion and global competitiveness of the operations of South African multinational companies in other countries by eliminating the potential for double taxation described above, it is proposed that transfer pricing provisions will not apply to certain cross-border financial assistance transactions (e.g. shareholder loans).

To this end, section 31(6) was introduced by the Taxation Laws Amendment Act, 22 of 2012 and came into effect on 1 January 2013 in respect of any year of assessment commencing on or after that date. In terms of this section, where any transaction, operation, scheme, agreement or understanding that comprises the granting of “financial assistance” by a person that is a resident to a CFC in relation to that resident, section 31 must not be applied in calculating the taxable income or tax payable by that resident in respect of any amount received by or accrued to that resident in terms of that transaction, operation, scheme, agreement or understanding if:

that CFC has a “foreign business establishment” as defined in section 9D(1); and

the aggregate amount of tax payable to all spheres of government of any country other than South Africa by that CFC in respect of any “foreign tax year” of that CFC during which that transaction, operation, scheme, agreement, or understanding exists is atleast 75% of the amount of normal tax that would have been payable in respect of any taxable income of that CFC had that CFC been a resident for that foreign tax year: provided that the aggregate amount of tax so payable must be determined:

after taking into account any applicable double taxation agreement and any credit, rebate or other right of recovery of tax from any sphere of government of any country other than South Africa; and

after disregarding any loss in respect of a year other than that foreign tax year or from a company other than that CFC.

The reason for the allowance of relief from the transfer pricing provisions in the case of high-taxed CFCs, is because the high-taxed nature of a CFC provides little overall net worldwide tax savings if the interest is understated and therefore is very little possibility for tax avoidance.

For more information, please contact:

Arnaaz Camay

executive tax

+27 11 269 7765

+27 82 787 9771

Post a comment

Post a comment Print article

Print article